The Australian Taxation Office are looking at arrangements involving the interposition of companies to avoid the application of Division 7A

Uncategorized

The Australian Taxation Office (ATO) issued Taxpayer Alert TA 2023/1 on 8 February 2023 in respect of the interposition of a holding company to access company profits tax-free.

What arrangements are the ATO looking at?

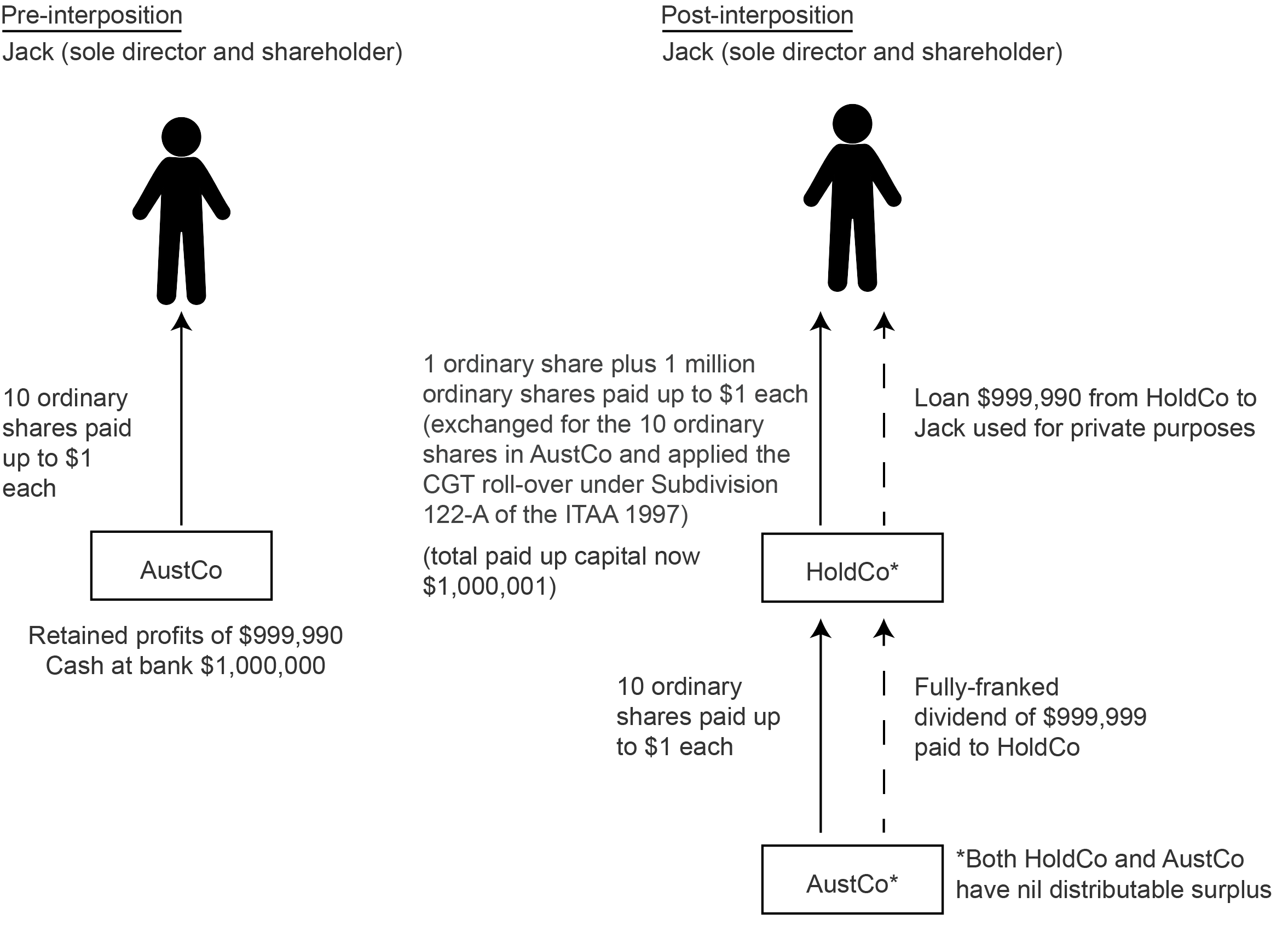

Broadly speaking, the ATO is looking at restructures seeking to circumvent the application of Division 7A of the Income Tax Assessment Act 1936 (Cth) (the ITAA1936), with the following features:

(Australian Taxation Office, 2023)

The circumvention of Division 7A in the above scenario occurs by virtue of the restructure resulting in both ‘AustCo’ and ‘HoldCo’ not having a ‘distributable surplus’. With no ‘distributable surplus’, Division 7A will not apply to deem a dividend to Jack in respect of the “non-complying Division 7A loan” he receives under the arrangement.

What concerns the ATO about such an arrangement?

The ATO flagged the following concerns about the avoidance of tax under such arrangements:

- whether there is any intention for the purported ‘loan’ to the individual to be repaid or whether the amount may be taken to be an assessable dividend paid to the individual pursuant to section 109C of Division 7A of the ITAA1936;

- whether the arrangements comprise a ‘dividend stripping’ scheme or operation, such that:

- section 177E of the ITAA1936 applies to include the amount of the purported loan in the taxpayer’s assessable income; and

- section 207-145 of the Income Tax Assessment Act 1997 (Cth) applies to cancel the franking credit on the dividend paid to the interposed company; or

- whether this is a scheme under section 177D of the ITAA1936 to which the general anti-avoidance provisions in Part IVA to the ITAA1936 apply.

What has been said about penalties?

The ATO has flagged “[p]enalties may apply to participants in and promoters of this type of arrangement. This includes serious penalties for promoters under Division 290 of Schedule 1 to the Taxation Administration Act 1953. Registered tax agents involved in the promotion of this type of arrangement may be referred to the Tax Practitioners Board to consider whether there has been a breach of the Tax Agent Services Act 2009.”

What are our thoughts at this stage?

Given the interposition of holding companies can occur due to a myriad of non-tax related drivers, it will be interesting to see how the ATO will address its concerns, particularly around the application of Part IVA and ‘dividend stripping’ more generally.

Please do not hesitate to reach out to the writers to discuss the ATO’s Taxpayer Alert and the underlying issues in more detail.

This article was written by Vincent Licciardi, Partner, Nima Sedaghat, Partner, and Oscar Dougherty, Senior Associate.

Australian Taxation Office, TA 2023/1 – Interposition of a holding company to access company profits tax-free, 2023, TA 2023/1 | Legal database (ato.gov.au).

Subscribe for publications + events

HWLE regularly publishes articles and newsletters to keep our clients up to date on the latest legal developments and what this means for your business. To receive these updates via email, please complete the subscription form and indicate which areas of law you would like to receive information on.

* indicates required fields