Shhh…a takeover is happening: ASIC review of deal leaks

Market Insights

ASIC review of media leaks

ASIC has initiated a targeted review of media leaks relating to deal activity, including a review of confidentiality rules. On 24 July 2024, ASIC Chair Joe Longo emphasised that ASIC remains concerned about the threats to market integrity posed by leaked transaction information during fundraising, mergers and takeovers activity. This follows on from ASIC’s warning in its December 2023 Corporate Finance Update that all parties involved in these transactions must vigilantly manage the risk of leaks or mishandling of confidential information.

ASIC’s main concern is unusual trading arising ahead of material price-sensitive announcements. Where there is suspicious trading activity, ASIC will investigate. Whilst Australian markets have a comparatively low occurrence of unusual trading ahead of M&A announcements compared to global peers, it is important to remain vigilant especially where there is an insider trading risk or risk of distorted market prices caused by leaks. The damage caused by information leaks extends beyond the impact on individual investors and can affect the broader economy.

Regulator response

Mr Longo points to a recent example where ASIC identified a media article foreshadowing a merger that was published an hour before market close, and monitored the price impact after publication as the market traded on that information for a brief period before trading was paused. The company then requested a trading halt after market close and an announcement was issued the next day. This also led to an ASX price query regarding the leak.

To enhance its enforcement capabilities, ASIC is establishing a dedicated investigation team to progress insider trading investigations. It is expected that ASIC will reach out to parties in a transaction with enquiries where confidentiality appears to have been compromised and a market impact can be identified. If warranted, briefs may be referred to the Commonwealth Director of Public Prosecutions for further action.

ASIC will consider how certain international peers manage media leaks as part of its review. For example, in the United Kingdom, the ‘put up or shut up rule’ means that media leaks can result in bidders being forced to firm up potential bids within 28 days or withdraw for six months.

What are the expectations of ASIC?

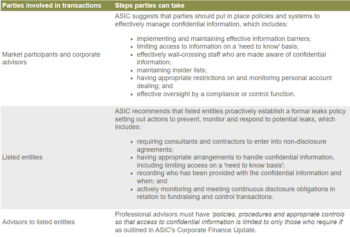

The table below sets out various steps that parties involved in transactions can take:

In its stated enforcement priorities for 2024, ASIC has outlined a new priority related to technology and operational resilience for market operators and participants to maintain market integrity.

Our corporate team can assist if you require any advice on structuring a deal or on implementing a risk mitigation strategy (including appropriate policies and procedures). We regularly advise on fundraising and control transactions and can assist your business with its next key milestone. Click here to read more about how dual listings enhance market access and liquidity or click here to read more about the impact of ESG on mergers and acquisitions.

This article was written by Thomas Kim, Partner, and Kenneth Lee, Special Counsel.

Subscribe for publications + events

HWLE regularly publishes articles and newsletters to keep our clients up to date on the latest legal developments and what this means for your business. To receive these updates via email, please complete the subscription form and indicate which areas of law you would like to receive information on.

* indicates required fields