“Mayday. It’s Payday” – Employers urged to be 1 July ready for historic payday super rules

Market Insights

Introduction

New payday super rules will apply from 1 July 2026, with the Federal Government introducing major reforms to the timing and administration of employer super contributions. Under the new rules, employers will be required to pay employees’ super at the same time as paying their salary and wages, replacing the current quarterly contribution cycle. The Government says that the reforms should address the growing problem of unpaid super and allow the Australian Taxation Office (ATO) to intervene faster to collect super for employees.

New rules

The new rules make major changes to the existing system. Although we anticipate the new rules will cause additional compliance and cash-flow pressures for employers and adjustments will be required in the short term, our observation is that certain draconian parts of the old rules have been abolished.

The main changes

- Employers will now be required to pay employees’ super within 7 business days after the day of payment of the employees’ salary and wage. Crucially, the super must be received and able to be allocated by the fund for it to be considered “on time”. Practically speaking, this means that super should be paid by employers as part of the ordinary pay run. All new employees’ super must be paid within 20 business days after the day of the first payment of the employees’ salary and wage. Further extensions are available in limited circumstances.

- Late payments of super, including payments of the super guarantee (SG) charge will now be tax deductible for employers. This includes payments made under a payment arrangement with the ATO. Payments of the ATO’s general interest charge (GIC) on outstanding SG charge will not be tax deductible.

- SG charge statements will be abolished and replaced by voluntary disclosure statements. Employers will be required to lodge voluntary disclosure statements with the ATO to obtain the benefit of any reductions or remissions of the administrative uplift (see below). The precise form of the voluntary disclosure statement has not yet been published by the ATO, but we anticipate it will be more sophisticated than the present spreadsheet format.

- Penalties of up to 200% which applied under the old rules for failing to pay super on time or not at all will be abolished and replaced by a “late lodgment penalty” of up to 50% of the SG charge (Late Lodgment Penalty). If the SG charge remains outstanding for at least 28 days, the ATO will be required to issue the employer with a notice warning the employer that if the charge remains unpaid for a further 28 days, the Late Lodgment Penalty will apply. Although the ATO will not have any power to remit the Late Lodgment Penalty, it appears that the penalty will reduce as the SG charge is paid. We consider this a substantially fairer and proportionate outcome for employers. Finally, although the 200% penalty will be abolished and replaced as mentioned, the penalties for misstatements to the ATO are not changing.

Other changes

- The distinction between ordinary times earnings and salary and wages will be abolished and replaced with one streamlined concept called “qualifying earnings“. Qualifying earnings will be the same for most employees to the existing definition of ordinary times earnings. Further, eligibility for higher income earners to opt-out of super altogether will be simplified and expanded.

- New taxing concepts “base SG shortfall” and “final SG shortfall” will be introduced. A base SG shortfall arises if an employee’s super is not paid on time. It is equal to the amount of super owing to an employee for a pay period less any amount paid on time. A final SG shortfall also arises if an employee’s super is not paid on time. However, it is calculated as the base SG shortfall less any further amount of super paid to an employee’s fund before the ATO makes a SG assessment. Similar to the existing system, all payments of assessed SG must be made to the ATO.

- The nominal interest charge will be abolished and replaced by “notional earnings“. Notional earnings are calculated by reference to the base SG shortfall described above and the GIC rate. We consider that this is a substantially fairer calculation for employers because notional earnings are calculated based on actual amounts of outstanding super owing to an employee. This is unlike the old system that calculated the nominal interest charge to lodgment of the SG charge statement without any regard to payments of super.

- The $20 administrative component will be abolished and replaced by a 60% “administrative uplift“. The administrative uplift is calculated as 60% of the final SG shortfall. It will also be possible to further reduce the uplift by disclosing shortfalls to the ATO. However, the disclosure rules have not yet been published as at the date of this briefing note. Similar to the above, we consider this is a substantially fairer and proportionate outcome for employers.

Overall, it will be crucial for employers to ensure that payroll and finance processes are updated to reflect the new rules. In particular, in three key areas. First, super processes must be fully and electronically integrated into ordinary pay runs so that employers can at least attempt to meet the strict 7 business day deadline. Second, employee data and election/choice records must be up to date and refreshed regularly to maintain currency and reduce the risk of rejected payments/bounce backs. Third, all updates and changes made to comply with the new rules must be permitted by the relevant employment contract, enterprise agreement, or award.

Impact on payroll and employment obligations

All Australian employers should be familiar with the complexity of payroll processes, and the potential for errors caused by this. The changes outlined above will increase this complexity and potential for error in a few ways.

First, it will require the employer to have robust systems in place to determine whether particular payments are superable or not.

Second, it will require the employer to determine from one pay period to the next whether an employee has reached their maximum superannuation contribution base or any other limit on the employer’s obligation to make superannuation contributions.

Changes to the Fair Work Act 2009 (Cth) (FWA) in January 2024 have allowed the Fair Work Ombudsman, employees, and, in relevant cases, their unions to pursue unpaid superannuation contributions through the courts (previously only the ATO had the right to oversee compliance with these obligations). This has created an extra option for recovery of superannuation which may be easier and quicker for some employees.

The combined effect of all of these changes is both to make it harder for employers to ensure compliance with superannuation obligations, and to make it easier for employees and others to pursue any contravention of these obligations.

Employers should be planning now for ensuring that they have robust and reliable systems to comply with these obligations.

Employers may have to upgrade their payroll systems to ensure compliance with these obligations, and also to avoid paying superannuation on elements of an employee’s remuneration that is not part of their “qualifying earnings”.

Some employers may seek to move to a longer pay period (say monthly rather than fortnightly) in order to reduce the number of superannuation and other remuneration payments that are required each year. Employers do not have an unfettered right to change the pay periods for their employees, and should be aware of rules regulating employees’ pay periods, which may arise from the FWA, applicable awards and/or enterprise agreements, employment agreements with individual employees, and even possibly the employer’s own policies and procedures.

Further, as superannuation is now regulated under the National Employment Standards in the FWA, employers who fail to comply with the reforms may also face potential scrutiny from the Fair Work Ombudsman, exposure to civil penalties, and the risk of claims from employees.

Cashflow pressure can result in personal liability for directors

For businesses already facing cash flow pressure, these changes will increase that pressure and may create solvency issues.

A company is insolvent if it is unable to pay its debts when they are due. As such, a persistent cash flow issue can mean that the company is insolvent. Directors have a duty to prevent a company from trading while it is insolvent. Where a company is insolvent and continues to trade, directors can face personal liability for the company’s debts as well as fines and other potential liability.

Where a company is insolvent, a director has a few options, the key ones being to appoint an external administrator (such as a voluntary administrator or a liquidator), or to seek to restructure the company. Where restructuring is pursued, it is common for the directors to seek the protection of safe harbour, which provides an exemption from liability under the insolvent trading laws if certain requirements are met and safe harbour is properly deployed. In the context of the transition to payday super, it is important to note that a company’s failure to pay employee entitlements, such as super, generally disentitles a director from relying on safe harbour.

As such, it is imperative that directors concerned about cash flow solvency of their business should seek restructuring advice on how to restructure the business and mitigate the personal risk they face as a director, as soon as possible.

12 months’ administrative reprieve will be granted by the ATO

The ATO will have real-time oversight of super payments once the new rules start. It will therefore be able to intervene faster, for example using audits, against non-compliant employers. In response, the ATO published its interim compliance guide called “Practical Compliance Guideline PCG 2026/1 – Payday Super – first year ATO compliance approach” (Guide). It applies from 1 July 2026 to 30 June 2027.

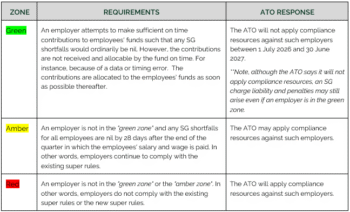

The Guide classifies employers’ compliance with the new rules into a “green zone“, “amber zone” and “red zone“, and then indicates how the ATO will respond to employers in the different zones. Obviously, the ATO will apply its resources to behaviours which it perceives to be higher risk. It will also monitor movement within the zones.

The following table paraphrases the Guide for readability and brevity.

Having regard to the Guide and the ATO’s pre-existing compliance mandate, our observation is that the ATO will likely use educative resources, such as letter campaigns, for employers in the green and amber zones, and enforcement resources, such as audits, for employers who do not comply with the super rules at all. The issue that we foresee is the accuracy with which the ATO deploys its resources, noting the new super rules are major reforms and full implementation must happen quickly. Further, the Guide is not binding on the ATO and therefore, an employer who is not compliant for a particular employee or pay period, but is otherwise in the green zone, may not necessarily be given a free pass. The employer’s zone may also change from pay period to pay period or be different for different employees. We hold a watching brief on how these and other implementation issues as they play out over the next 12 to 24 months.

HWLE Lawyers national tax and workplace teams help clients to implement the new rules in their businesses, including to update their payroll and finance processes. We advise on all aspects of the new and old law, particularly for employers defending claims brought by the ATO or employees. Our national litigation team has restructuring and insolvency expertise and regularly advises directors on restructuring and mitigation of personal liability for insolvent trading and safe harbour.

This article was written by Vincent Licciardi, Partner, Melissa Ferreira, Partner, Tim Frost, Partner, and Isabelle Smith, Senior Associate.

Subscribe for publications + events

HWLE regularly publishes articles and newsletters to keep our clients up to date on the latest legal developments and what this means for your business. To receive these updates via email, please complete the subscription form and indicate which areas of law you would like to receive information on.

* indicates required fields