Foreign Investment Review Board (FIRB)

Australia’s FIRB is responsible for examining foreign investment proposals which require approval under Australia’s foreign investment regime to proceed, including acquisitions of certain interests in Australian entities, businesses and land. Further notification of particular acquisitions are required to be reported to the Register of Foreign Ownership of Australian Assets, even where FIRB approval was not required to undertake the acquisition.

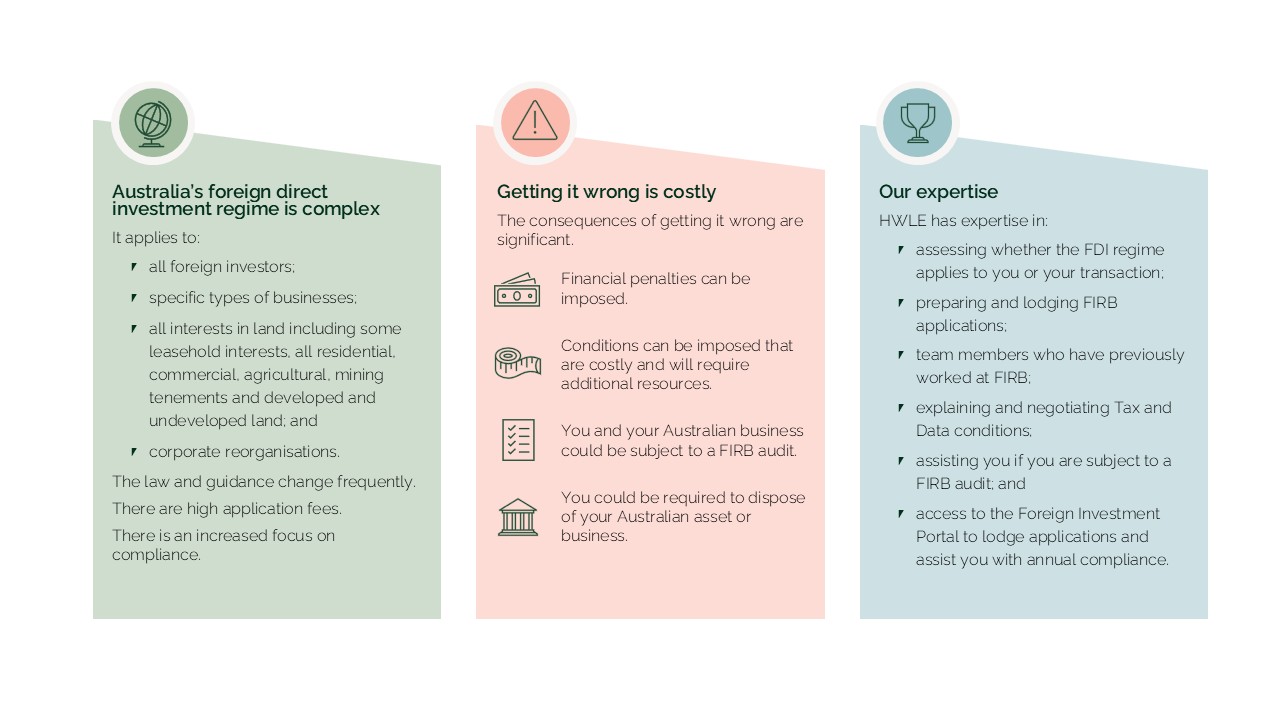

Our team will guide you through any FIRB approval requirements and will work with you to ensure compliance with ongoing reporting obligations.

To view our Doing Business in Australia guide, please download below.

Foreign Investment

Our experience

- Foreign government-owned entity Advising on the FIRB approval requirements arising from a proposed long-term leasehold arrangement with Melbourne Airport, including structuring its bid conditions under a competitive tender to address the FIRB approval requirements, as well as applying for and obtaining FIRB approval to allow the entity to start operating in Australia.

- WestWind Energy Pty Ltd Advising on its FIRB compliance obligations in connection with its various wind farm projects, including advising on FIRB triggers, obtaining exemption certificates and stand-alone FIRB approvals and assisting with ongoing compliance activities associated with its FIRB approvals (including obtaining a FIRB exemption certificate to acquire up to $210 million of agricultural land for the purposes of its $2.1 billion Golden Plains Wind Farm Project).

- Resolution Life Australasia Limited Advising in relation to ongoing FIRB compliance for the investment and management of the $30 billion held in its statutory life insurance funds, as well as the FIRB implications arising from the proposed restructure of its investment trusts.

- Inbound investors Advising on compliance with Australia’s foreign direct investment regime and on the security of critical infrastructure assets.

- Taxpayers Acting in several significant tax audit matters involving complex transactions with offshore entities, exchange of information between the ATO and foreign revenue authorities.

- Nomura Advised major Japanese institution, Nomura, on its $300 million acquisition of a global IT services company from Australian private equity firm, The Growth Fund.

- Nature’s Care Advised on the trade sale of Nature’s Care, a leading vitamin and supplements business, to a Chinese private equity consortium by way of competitive sale process. The deal was one of the largest private equity transactions in Australia in 2018 and earned his team a nomination in the finals of the Australian Law Awards 2018.

- Private equity funds Advised on tens of billions of dollars of private equity transactions acting for domestic and global funds, founders and portfolio companies. Some of these transactions were among the largest and most complex private treaty M&A deals in the years they were completed.

- a.k.a. Brands Advised NYSE-listed, a.k.a. Brands (NYSE: AKA), on all of its investments in Australia (including the acquisition of Culture Kings, which was one of the largest private equity backed deals of 2021 in Australia) and the Australian aspects of its subsequent $2 billion listing on the New York Stock Exchange.