How dual listings enhance market access and liquidity

Market Insights

Dual listing has long been a strategy used by listed companies to expand their market particularly in this current competitive and seemingly cutthroat business climate. This option is currently in vogue as demonstrated by the recent dual listing of Metals Acquisition Limited (ASX:MAC) on the ASX and NYSE in February 2024. MAC raised A$325 million via the issue of CHESS depositary interests at A$17.00 each, with an implied market capitalisation of A$1.18 billion that reflects strong support from Australian and offshore institutional investors. Looking forward, 2024 will likely see US aluminium giant Alcoa establish its secondary listing on the ASX and Australia-based consumer healthcare company Wellnex Life progress its proposed dual listing on the LSE.

We explore the benefits and disadvantages of pursing a dual listing or cross listing as a key transaction strategy for ASX listed companies. We will use the term ‘dual listing’ to refer to primary/secondary listings, although cross listings are technically where a company lists equity securities on one or more secondary exchanges in addition to its primary domestic listing, whilst dual listings are where a company has its securities primarily listed on multiple exchanges which is less common. We consider this from the perspective of the Australian Securities Exchange (ASX) being the home exchange (Home Exchange) and the foreign exchange (Overseas Exchange) being in a key market such as London, New York, Toronto or Hong Kong.

Being dual listed has multiple benefits including:

- Liquidity – access to new markets may increase the investor pool and create greater liquidity.

- Longer trading hours – shares traded for longer periods due to differing time zones meaning the trading day extends beyond standard trading hours.

- Flexible conversion – the ability to convert between underlying shares listed on ASX and the depositary receipts issued by the Overseas Exchange.

- Reduced exposure – diversification to protect against country or region-specific economic issues.

The company’s board must weigh the benefits against potential disadvantages including:

- Increased costs – initial and ongoing costs of being listed on multiple exchanges.

- Increased compliance – board and management involvement to manage increased reporting and governance requirements and potentially rules which do not align (including timeframes and corporate actions). Generally, the company is required to nominate a primary / secondary exchange and the rules of the primary exchange will prevail, although the rules of the secondary exchange are accommodated where possible.

- Arbitrage risk – potential for arbitrage arising from the securities being denoted in different trading currencies and potential lag time arising when trading of the securities is halted on the Home Exchange to the time when trading on the Overseas Exchange is stopped.

A common approach for ASX dual listed companies in foreign jurisdictions involves using depositary receipts, for example, these receipts are available in many jurisdictions including the UK, USA, and Hong Kong.

1. Australian overview of ASX share registers

Per Australian law, companies issue fully paid shares that carry voting rights and have no par value. Generally, all shares are freely transferable, subject to the transfer not breaching Australian corporate laws or applicable ASX listing rules. Certain shares can be issued as restricted or voluntary escrowed which impacts transferability.

The share register for ASX listed companies is typically comprised of two sub-registers: (a) the CHESS sub-register for shares traded on a regulated market where CHESS stands for clearing house electronic sub-register system and its objective is to facilitate the buying and selling of ASX shares, and (b) the issuer sponsored sub-register for shares transferred off-market. Shares are held in uncertificated form with no physical share certificates issued. There is a free flow of shares between sub-registers with no overlap and a particular share is only on one sub-register at any point in time.

2. Structure of dual listings

There are two main options for structuring a dual listing and which option is chosen will depend on the regulatory requirements of the Overseas Exchange and the foreign jurisdiction. An entity that is listed on the Home Exchange may be required to either: (a) have its shares directly listed and traded on an Overseas Exchange, or (b) alternatively listed as an instrument used for trading of shares on the Overseas Exchange. For example, the Stock Exchange of Hong Kong (SEHK) only permits companies listed in certain accepted jurisdictions to have their shares directly traded on the SEHK and if not, depositary receipts will be issued as instruments to facilitate the trading of shares on the SEHK.

3. Depositary receipts: How do they work?

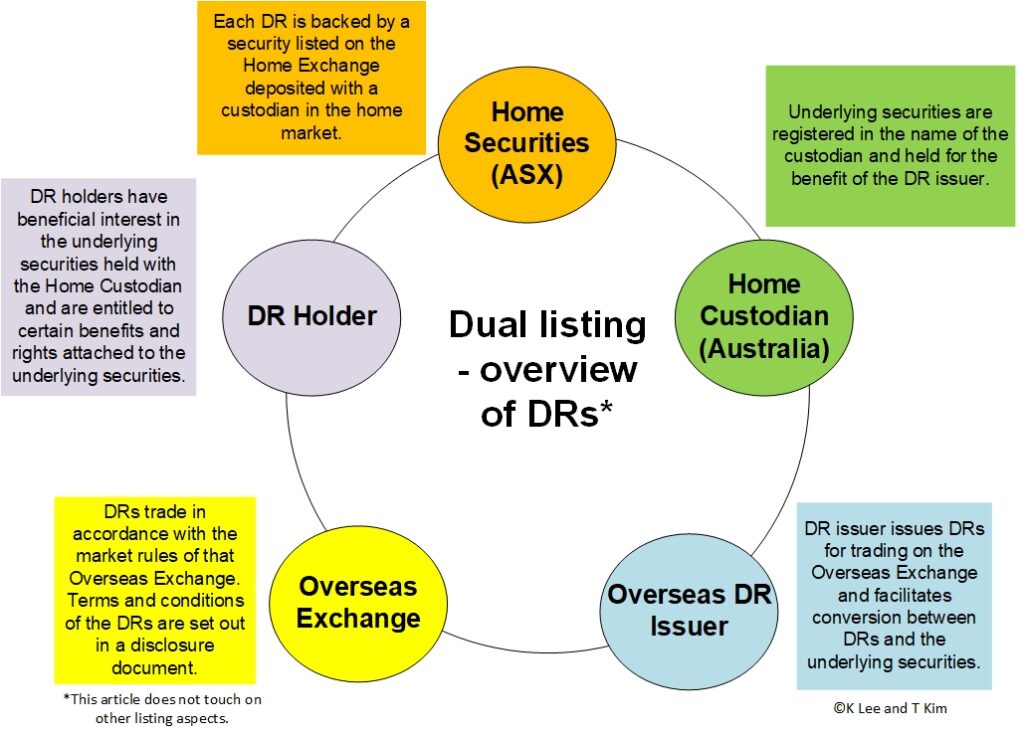

Depositary receipts are instruments issued by an Overseas Exchange that represent beneficial interest in an underlying security listed on a Home Exchange (DRs). DRs may also be referred to as CHESS depositary interests on ASX (CDIs), American depositary receipts (ADRs) and UK depositary interests.

A DR is issued for trading by an overseas intermediary (Overseas DR Issuer) where the registrar agreement is typically entered into with the underlying company. Each DR represents a specific number of underlying securities listed on the Home Exchange (Home Securities) and a custodian (Home Custodian) holds those Home Securities on trust for the Overseas DR Issuer. Following admission to trading, the DRs are traded in the foreign currency and in accordance with their market trading rules of the Overseas Exchange and generally have the same ticker code as the Home Securities on the ASX.

4. Share shunting: conversion of underlying securities into depositary receipts

The DRs and the Home Securities are fully transferrable via a process known as share shunting or transmutation of shares.

When shunting shares from the ASX to the Overseas Exchange, the shareholder must provide the ASX register with a written direction, which will remove the shares from their holding, and place those shares into the control of the foreign register under the same name of the shareholder which reflects the beneficial ownership. This will require the ASX shares to be held by a Home Custodian for the benefit of the Overseas DR Issuer administering the foreign register. Only shares that have been registered on the foreign register are tradeable on the Overseas Exchange as DRs. Once transferred, DRs will not be tradeable on the ASX unless shunted back for shares.

5. Specific considerations with depositary receipts

Given investors issued DRs (DR Holders) are not direct shareholders in the ASX listed company, they cannot directly exercise shareholder rights except through the Overseas DR Issuer. Although each DR registered with the Overseas Exchange represents evidence of beneficial ownership of the underlying shares, such beneficial ownership will not necessarily be recognised by an Australian court.

DR Holders must look solely to the Overseas DR Issuer (which then instructs the Home Custodian) for the payment of dividends, exercise of voting rights and any other rights attaching to the underlying shares. Dividends are typically paid later than for those directly holding ASX shares. The Overseas DR Issuer will utilise reasonable endeavours to pass on benefits of non-cash distributions to DR Holders. Exercise of other shareholder rights may be limited.

To benefit from direct shareholder rights under Australian law or the company’s constitution, a shareholder must shunt the shares back to the ASX register at the cost of the requesting shareholder.

6. Specific considerations with dual listings

Given there are two separate trading markets for dual listed shares, there is no guarantee of good liquidity or an active trading market on both exchanges. The company may find most of its shares are traded on one exchange with limited trading volume on the other.

The speed by which DRs are exchanged for underlying shares on ASX, and vice versa, can cause differences between trading prices and result in arbitrage trading where investors aim to exploit differences between the two exchanges. This could adversely impact volatility of the market price.

Finally, regarding governance, the company must be across differences in corporate actions, annual reporting, listing rules or continuous disclosure requirements.

7. Conclusion

The company’s board must decide whether the benefits in pursuing a dual listing outweigh the disadvantages. Ultimately, it is about scale where an ASX company aiming to raise significant funds via a dual listing can reach more institutional and cornerstone investors in another jurisdiction. Access to expanded capital markets is beneficial for any company requiring growth funds. Finally, there are reputational advantages as certain exchanges are renowned or viewed as prestigious for certain industries, such as technology companies aspiring to list on the Nasdaq to attract higher valuations.

This article was written by Thomas Kim, Partner and Kenneth Lee, Special Counsel. It was first published in Solicitors Journal on 8 May 2024.

HWL Ebsworth Lawyers was ranked 3rd for number of equity and equity-related deals in Australia by Refinitiv (formerly Thomsons Reuters) for Q1 2024.

Subscribe for publications + events

HWLE regularly publishes articles and newsletters to keep our clients up to date on the latest legal developments and what this means for your business. To receive these updates via email, please complete the subscription form and indicate which areas of law you would like to receive information on.

* indicates required fields