ESG UPDATE – Australia’s implementation timeline for climate reporting

Market Insights

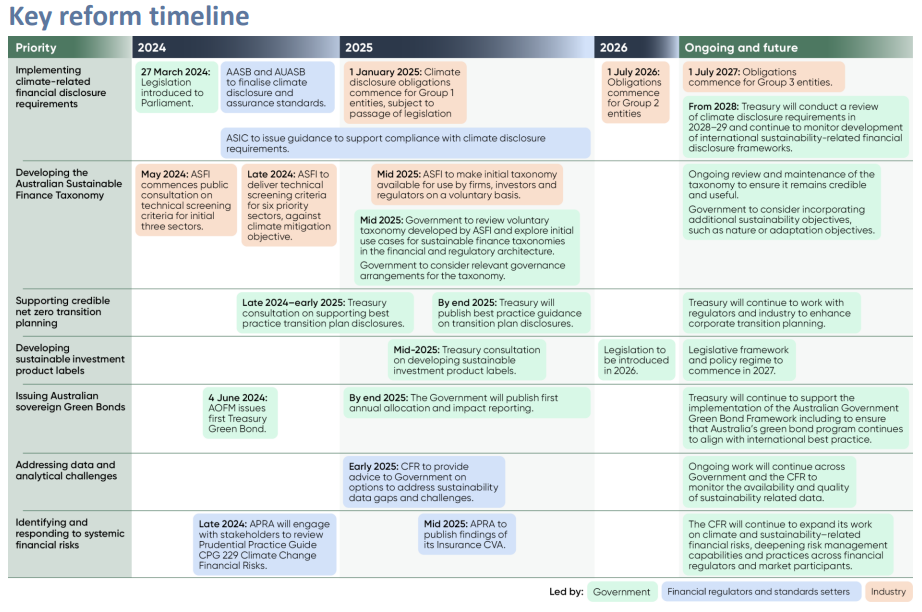

Overview of Australia’s implementation timeline

This is a concise update to give businesses an overview of what is happening in the ESG space, specifically the rollout of climate reporting in Australia. As businesses may be aware, the government on 27 March 2024 introduced climate reporting legislation into the house of representatives in Schedule 4 to the Treasury Laws Amendment (Financial Markets Infrastructure and Other Measures) Bill 2024 (Cth) (Bill). Following this, the Bill was introduced to the senate on 24 June 2024.

Source: Australian Government – The Treasury, Sustainable Finance Roadmap (June 2024) page 15.

The roadmap depicts key milestones for Australia over the next three to five years. It encompasses three main themes, being to improve transparency on climate and sustainability, enhance financial system capabilities, and focus on Australian government leadership and international engagement.

Here are the key takeaways for climate reporting in Australia:

- Government to implement mandatory climate disclosure requirements for large businesses and financial institutions with legislation currently before parliament, which are expected to commence for groups 1, 2 and 3 entities on 1 January 2025, 1 July 2026 and 1 July 2027 respectively. The disclosures aim to provide investors with increased transparency and comparable information about entities’ climate-related exposures in terms of risks and opportunities and their strategies and plans. For further details, please refer to our previous article available here.

| Grouping | Thresholds for reporting entities |

|---|---|

| Group 1 - very large entities (1 January 2025 onwards) | Entities required to report under Chapter 2M and that fulfill two of the three thresholds: (1) over 500 employees; (2) value of consolidated gross assets is $1 billion or more (at end of financial year of company and any entities it controls); (3) consolidated revenue is $500 million or more (for the financial year of the company and any entities it controls). |

| Group 2 - large entities (1 July 2026 onwards) | Entities required to report under Chapter 2M and that fulfill two of the three thresholds: (1) over 250 employees; (2) value of consolidated gross assets is $500 million or more (at end of financial year of company and any entities it controls); (3) consolidated revenue is $200 million or more (for the financial year of the company and any entities it controls). |

| Group 3 - medium entities (1 July 2027 onwards) | Entities required to report under Chapter 2M and that fulfill two of the three thresholds: (1) over 100 employees; (2) value of consolidated gross assets is $25 million or more (at end of financial year of the company and any entities it controls); (3) consolidated revenue is $50 million or more (for the financial year of the company and any entities it controls). Group 3 (Medium entities) can choose to instead state that they have no material climate risks and opportunities and choose not to report. |

- ASIC will engage with and assist reporting entities to comply with the climate disclosure requirements, including issuing guidance and considering the impact on existing financial reporting relief.

- The proposed climate reporting legislation will require disclosure of material climate risks and opportunities, governance arrangements, scope 1 and 2 emissions, scope 3 emissions from the second reporting year, impacts of cash flows, revenues and asset values, and scenario analysis against at least two scenarios (with one scenario being a 1.5 degrees Celsius change in line with the Paris Agreement).

- AASB and AUASB to finalise climate disclosure and assurance standards in late 2024.

- Further consultation expected on proposed consolidation of the financial reporting bodies, before related legislation is introduced.

- Treasury in conjunction with the Council of Financial Regulators will conduct a review of climate-related financial disclosure requirements in 2028-29.

In parallel, the Australian Sustainable Finance Institute is expected to finalise development of the initial Australian sustainable finance taxonomy by the end of 2024. This covers green and transition activities that contribute to climate change mitigation, in six priority sectors, as well as ‘do no significant harm’ and ‘minimum social safeguard’ criteria. The draft taxonomy will be reviewed by the government by mid-2025 who will consider relevant governance arrangements.

We will keep an eye on these developments and update you at the appropriate time once regulatory guidance is available. This is expected in the second half of 2024. We will provide a release outlining the requirements and how businesses can get ready.

Further details

To read about past key ESG milestones, please refer to previous articles by the authors (Thomas and Kenneth) on the:

- climate reporting legislation in parliament (accessible here);

- development timeline and earlier Treasury proposals (accessible here);

- codification of key climate targets into Australian law (accessible here); and

- impact of ESG on mergers and acquisitions (accessible here).

Thomas and Kenneth are corporate lawyers who have a particular interest in how ESG and climate change is shaping corporate transactions, as businesses adapt to climate change impact and the transition to a net zero emissions world.

If your business is unclear on next steps and requires assistance on this journey, please contact us. We regularly advise boards on their governance obligations and expectations on directors given new legislative requirements.

This article was written by Thomas Kim, Partner and Kenneth Lee, Special Counsel.

Subscribe for publications + events

HWLE regularly publishes articles and newsletters to keep our clients up to date on the latest legal developments and what this means for your business. To receive these updates via email, please complete the subscription form and indicate which areas of law you would like to receive information on.

* indicates required fields